Blog > Settlement Day in Pennsylvania: What You Need To Know

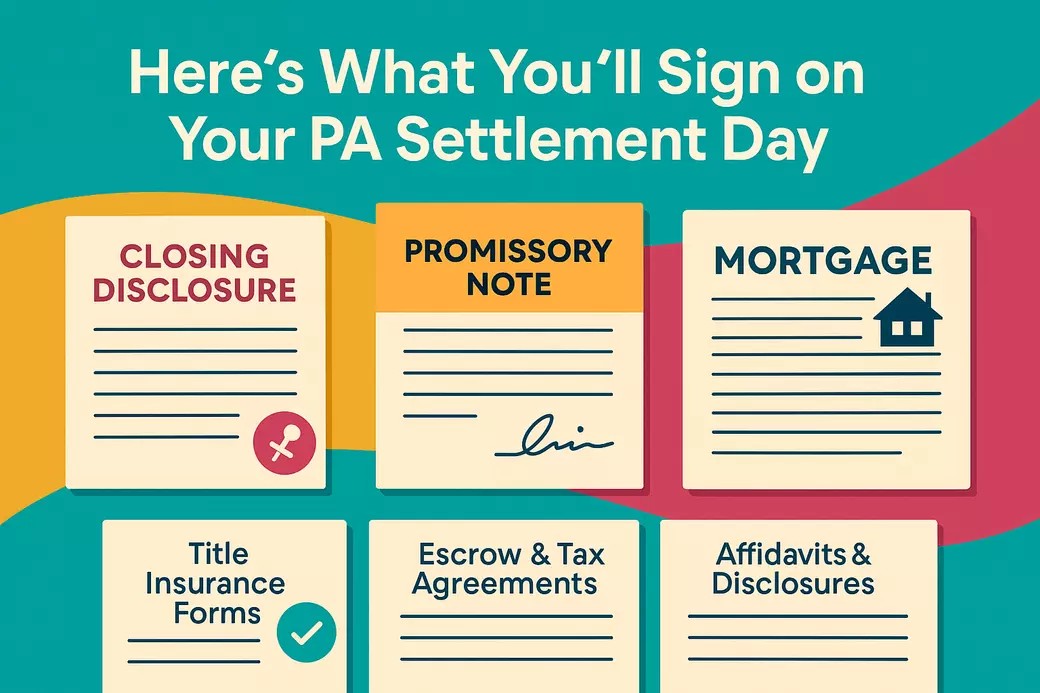

It’s finally here…Settlement Day! Commonly known as “going to closing” this is the day where a real estate deal is made official. It’s the day where you’re trading money, signing a deed and finally getting the keys to your dream home. The surprise for so many people is just how many papers are waiting to be signed. Relax, it’s not as intimidating as it appears once you understand what they are. We’ll go through all the critical documents so you’ll be ready.

📑 If You’re the Buyer: Documents You’ll Sign

If you’re financing your purchase with a mortgage, the pile of papers will be taller. Certain forms will not require you to sign them all of the way through, some are loaded with legal language and disclosures. These are the big ones you’ll sign:

📝Closing Disclosure (CD)

This is the Single Most Important Document. It outlines your loan terms, interest rate and all closing costs, down to your monthly payment. 📌 This will be given to you and your Realtor about 3 days before settlement day. Take plenty of time to review this carefully. There are times this document isn’t available until the day before settlement, but it’s important to read it through in its entirety prior to coming to the table. If you have any questions, or see any discrepancies, discuss them with your Realtor and the title company that sent out the disclosure. Be sure to take your copy along on settlement day and check it with the one you are asked to sign. You’ll want to make sure they’re exactly the same.

This is the Single Most Important Document. It outlines your loan terms, interest rate and all closing costs, down to your monthly payment. 📌 This will be given to you and your Realtor about 3 days before settlement day. Take plenty of time to review this carefully. There are times this document isn’t available until the day before settlement, but it’s important to read it through in its entirety prior to coming to the table. If you have any questions, or see any discrepancies, discuss them with your Realtor and the title company that sent out the disclosure. Be sure to take your copy along on settlement day and check it with the one you are asked to sign. You’ll want to make sure they’re exactly the same.

📝Promissory Note

Your solemn written pledge to the bank that you’ll pay back your mortgage. It establishes how much you are borrowing and the terms under which you agree to repay it.

📝Mortgage Document

This legally attaches your loan to your new home. If you don’t make the payments, the lender can foreclose and take back the property. It’s also filed at the county office.

📝Title Insurance Forms

Title insurance covers you in cases where someone else later claims ownership of your property. It’s an added level of security. You should’ve discussed with your Title company before settlement if you wanted this type of security and how much it would cost.

📝Escrow & Tax Agreements

These forms establish your escrow account for property taxes and homeowner’s insurance. The mortgage company is going to make sure those bills get paid on time by including the cost into your monthly mortgage payment. This money is ‘put aside’ by the mortgage company each month into your own personal escrow account. When the bills are due, the mortgage company pays them from this account.

📝Affidavits & Disclosures

Short forms where you confirm:

✔ Your identity

✔ That you will occupy the home (if it is your primary residence)

✔ That the deal is legit, accurate and you are legally able to sign the papers

📑 If You Are the Seller: Key Documents You Will Sign

Sellers have less to sign, but each piece of paper is essential in transferring title to the new owner:

📝Closing Disclosure (CD)

This is the document that counts. It itemizes fees, refunds for taxes you’ve already paid, payoffs of any loans and your final net proceed from the sale. 📌 You and your Realtor will get this 3 days before closing, so look at it closely in advance. Sometimes this may not be available to the day before settlement, but the crucial thing is to look it all over before you come to the table. Any concerns or questions should be discussed with your Realtor and the title company that provided the disclosure. Be sure to take a copy with you and compare it to the version presented to you at signing. You need to make sure they match perfectly.

This is the document that counts. It itemizes fees, refunds for taxes you’ve already paid, payoffs of any loans and your final net proceed from the sale. 📌 You and your Realtor will get this 3 days before closing, so look at it closely in advance. Sometimes this may not be available to the day before settlement, but the crucial thing is to look it all over before you come to the table. Any concerns or questions should be discussed with your Realtor and the title company that provided the disclosure. Be sure to take a copy with you and compare it to the version presented to you at signing. You need to make sure they match perfectly.

📝The Deed

The golden ticket — it’s what tells everyone the buyer owns it now. You’ll sign the paper and the title company will get it notarized.

📝Payoff Authorization

If you still owe a mortgage on your home or HELOC, this grants the title company permission to pay it off at closing. The company will process all money transactions.

📝Transfer Tax Forms

In Pennsylvania, purchasers and sellers usually equally divide the transfer tax. Each will pay 1 percent of the purchase price of the home, unless something else has been negotiated.

📝Affidavit of Title

Before settlement the title company will do a title search to see what liens or other loans there are on the home and they will let you know before coming to the table. This form confirms the seller actually owns the home and there aren’t any hidden liens.

📍 How Are Pennsylvania Closings Different?

•Table closings: Buyers and sellers sit at the same table to sign everything. If there is no mutually agreeable time, however, the buyers and sellers can sign at separate times within the same day. Not every piece of paper can be signed electronically. Pennsylvania still requires physical signing at this time. If the buyers (or sellers) are disabled, or if they reside in a different state, the title company will find a notary to come to them and have them sign the papers.

• Transfer taxes: In Pennsylvania, buyers and sellers typically split the transfer tax. Each will pay 1% of the purchase price of the home unless it’s been negotiated differently.

• Recording the deed: Once signed, the deed is sent to the county for recording. After it’s official, the buyer legally owns the home.

✅ Tips For a Smooth Signing

• Spend time before coming to the table reviewing your Closing Disclosure and Settlement statements —clear up any discrepancies right away.

• Don’t forget to bring your state-issued photo ID with you (driver’s license or passport).

• Have your questions answered before you sign anything—never let yourself feel pressured.

• The process should take 1 to 2 hours.

• Make sure you leave with copies of everything you sign and be sure you store them somewhere safe.

💬 Quick FAQ

Do buyers and sellers sign the same papers?

No. Buyers sign loan and title documents. Sellers sign the deed, payoff forms, and tax paperwork.

How long does settlement take?

Most closings in PA take 1–2 hours.

Can sellers sign early?

Yes, sellers often pre-sign. Buyers almost always sign in person.

________________________________________

________________________________________

🎉 The Bottom Line

On Pennsylvania settlement day, the signatures make it real.

• Buyers: sign loan, mortgage, title, and escrow documents.

• Sellers: sign the deed, payoff paperwork, and transfer forms.

• Buyers: sign loan, mortgage, title, and escrow documents.

• Sellers: sign the deed, payoff paperwork, and transfer forms.

When the final signature is complete and the deed is recorded, the home officially changes hands. Keys are exchanged, and you can finally say, “Closed!”